Condo Insurance in and around Waco

Waco! Look no further for condo insurance

Condo insurance that helps you check all the boxes

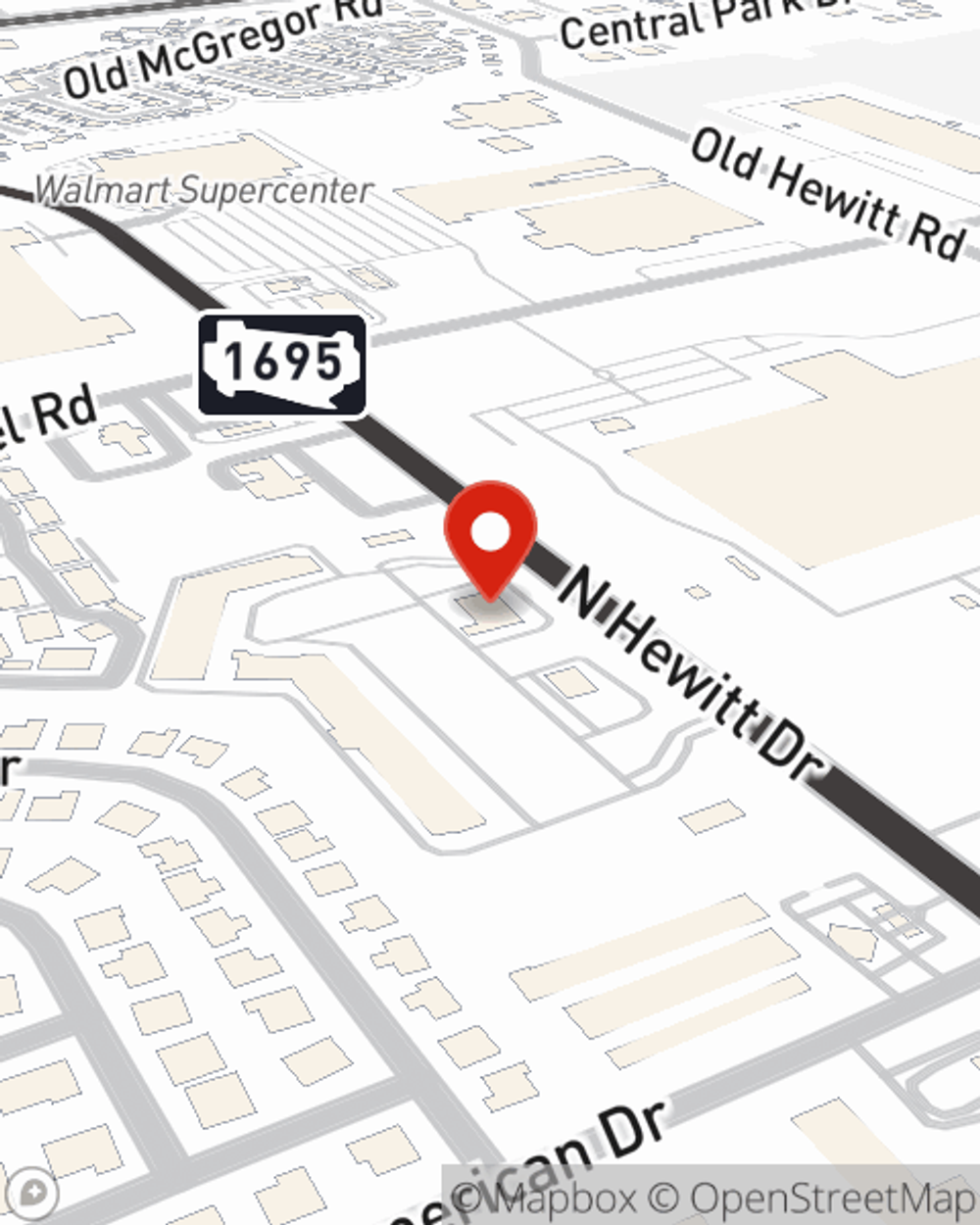

- Waco

- Woodway

- Hewitt

- Lorena

- McGregor

- Crawford

- Robinson

- McLennan County

- West

- China Spring

- Bellmead

- Moody

- Troy

There’s No Place Like Home

When considering different providers, deductibles, and coverage options for your condo insurance, don't miss checking out the options that State Farm offers. These coverage options can help protect not only your condo but also your personal belongings within, including sports equipment, souvenirs, electronics, and more.

Waco! Look no further for condo insurance

Condo insurance that helps you check all the boxes

Condo Coverage Options To Fit Your Needs

When a tornado, an ice storm or vandalism cause unexpected damage to your townhome or someone trips in your home, having the right coverage is important. That's why State Farm offers such wonderful condo unitowners insurance.

There is no better time than the present to contact agent Matt Dill and explore your condo unitowners insurance options. Matt Dill would love to help you choose the right level of coverage.

Have More Questions About Condo Unitowners Insurance?

Call Matt at (254) 752-2022 or visit our FAQ page.

Simple Insights®

Community and urban gardening

Community and urban gardening

Community and urban gardens are an excellent place for growing fresh food. Learn how to secure your garden plot and how to make the most of your space.

How to deal with noisy neighbors or issues

How to deal with noisy neighbors or issues

From noisy neighbors and arguments over property lines to adventurous pets, there are ways to successfully resolve disputes between neighbors.

Simple Insights®

Community and urban gardening

Community and urban gardening

Community and urban gardens are an excellent place for growing fresh food. Learn how to secure your garden plot and how to make the most of your space.

How to deal with noisy neighbors or issues

How to deal with noisy neighbors or issues

From noisy neighbors and arguments over property lines to adventurous pets, there are ways to successfully resolve disputes between neighbors.